LEVY

Educational Programs, Maintenance and Operations (M&O) Levy

Voters in the Battle Ground Public Schools district approved a four-year Educational Programs, Maintenance and Operations (M&O) replacement levy on Feb. 14, 2017, with 53.69 percent of the vote. Collections for the levy begin January 2018. This levy provides about a quarter of the district’s total operating budget and expires at the end of 2021.

Levy dollars are the difference

Levy dollars make up the difference between what the state provides for K-12 education and what it costs to operate schools while providing a quality learning environment.

The levy allows educational programs and facility services to continue at a level that provides an education focused on every child’s emotional and academic well-being and enables students to engage in quality learning environments.

Finances

The below Tax Rate Chart shows the proposed M&O tax rate and levy dollars collected. The four-year levy will raise: $31,680,000 in 2018, $33,260,000 in 2019, $34,930,000 in 2020, and $36,670,000 in 2021. The tax rate for the levy was projected to stay the same as the 2016 levy rate. While the rate is projected to stay flat, the proposed levy would generate additional total funds for the district each year. The actual impact on property owners will depend on the increase or decrease in assessed value. The total amount of the levy collected cannot increase even if the district’s assessed value increases.

What does the levy provide for students?

Much of what the levy pays for is people. People are key to providing a quality education and getting students the support they need in both academics and social-emotional learning. Battle Ground’s levy helps keep class sizes small by providing an additional 260 teachers and school and district support staff above what the state funds. Teachers lead classes and programs and classified staff provide educational and administrative support in multiple areas, from health services and safety to office staff and maintenance.

Click the chart to enlarge:

Chart Notes:

- School Psychologists – Students perform better academically if their social-emotional needs are met. School psychologists are uniquely qualified members of school teams that support students’ ability to learn and teachers’ ability to teach. They apply expertise in mental health, learning, and behavior to help children and youth succeed academically, socially, behaviorally, and emotionally.

- Nurses – The state pays for less than two nurses for 18 schools. Levy funds allow us to keep 12 full-time nurses on staff to provide on-site medical care to students.

- Security – Many students and parents have said they feel safer knowing security personnel monitor their campus.

- Teaching assistants – Support students in the classroom, at recess, during lunch, before school and at release time.

- Technology Services – BGPS is launching a 1:1 initiative so that every student has equal access to technology.

- Maintenance/Grounds/Custodial/Warehouse – With 18 schools in the district, keeping our campuses well maintained and adequately clean is a huge undertaking. Levy funds enable BGPS to hire enough staff to keep up with the constant demand.

- Principals & Assistant Principals – The levy provides for assistant principals who help in areas of positive behavior, attendance and staff support.

- Other certificated staff – Class size is important to BGPS, and these 92 staff allow the district to have some of the smallest class sizes in the region, providing a more effective, individualized learning environment.

Below are just some of the examples of what the levy funds:

- About 25 percent of teachers, support and administrative staff

- Small class sizes

- Art, music, drama

- Textbooks and curricula

- After-School Activities

- School psychologists and counselors

- Security and communications

- Transportation

- Professional Development

- Building maintenance

Where are levy dollars spent?

Levy dollars are pooled with state funds to help pay for basic services that provide a quality education. The levy enables the district to keep class sizes small, maintain facilities, supply technology resources to students, and provide for staff that enhance security, learning experiences and after-school activities.

The levy provides basic educational supports that the state does not fund, including textbooks and curricula, professional development, transportation, and building maintenance. It also pays for health services, music and art classes, after-school activities, drug prevention education, instructional technology, building security, education for students with special needs, utilities, and insurance.

Local funding provides the difference between what the state pays for and what it actually costs to operate schools. In Washington, 97 percent of the 295 school districts rely on levy money to provide important student programs and services.

Election Information

Clark County voter registration information is online at https://www.clark.wa.gov/elections/voter-registration. Residents can register to vote online up to 29 days before Election Day or in person up to 8 days before Election Day.

NOTE: Some senior and disabled homeowners may be eligible for a property tax exemption, based on income. Please call the Clark County Assessor’s Office at (360) 397-2391 for details.

Levy Information Presentation

Levy Information Nights Presentation web Jan2017

Frequently Asked Questions

What is the difference between a levy and a bond measure?

Levies provide for learning and bonds go to construct buildings and pay for capital renewal projects, for example, refurbishing and re-roofing buildings and replacing flooring and HVAC systems. Battle Ground voters last approved a bond in 2005 to finance the construction of several new schools, additions and improvements.

What will this levy cost?

The four-year levy will raise: $31,680,000 in 2018, $33,260,000 in 2019, $34,930,000 in 2020, and $36,670,000 in 2021. The amount of the levy collected is a total amount for each year; it cannot increase even if the district’s assessed value increases.

Why is BGPS asking for an increase in the amounts collected each year?

The district has experienced increasing costs each year in several areas:

- Transportation

- Personnel costs (competitive pay)

- Substitute rate

- Population growth

- Technology (Replacement, building equity, 1:1 computing initiative)

- Curriculum updates

- Building maintenance and operations

Battle Ground’s expenses that are paid for out of levy funds increased by more than $5.2 million** in two years. The district has experienced the largest increases in the following categories:

|

2015-16 |

2016-17 |

||

|

Transportation |

$0.2 million |

$0.6 million |

|

|

Certificated negotiated TRI* |

$1.7 million |

$0.9 million |

|

|

Classified negotiated salary |

$0.4 million |

— |

|

|

Administrator salaries (state-mandated COLAs) |

3.0% $0.2 million |

1.8% $0.1 million |

|

|

COLAs for unfunded staff (state-mandated) |

3.0% $0.7 million |

1.8% $0.4 million |

|

|

TOTAL INCREASE |

$3.2 million |

$2.0 million |

$5.2 million** |

*TRI (Time, Responsibility and Incentive) pay compensates teachers for days beyond their 180-day contracts in recognition of the work they do in the summer and outside of the school day to prepare for teaching.

What is levy equalization?

Levy equalization is money the state gives to “property-poor” school districts that approve levies. Battle Ground is a property-poor school district with little industry that usually has a higher assessed value than residential property. Levy equalization money goes only to school districts that pass a levy. Under the current levy, Battle Ground Public Schools receives approximately $6.7 million in levy equalization each year.

How does the district’s central administration costs compare to that of other districts?

Statewide, the average school district’s central administration costs, including salaries of district administrators, equate to $703 per-student, per-year. In Battle Ground, that number is $626 per-student, per-year. (Source: OSPI)

Why do schools need levies in the first place? Doesn’t the state pay for public schools?

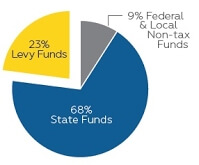

The state funds approximately 68 percent of the cost of basic education in Battle Ground schools; however, the funding model is changing in future years.

Is there relief for people on a fixed income? Is there a tax break for seniors and disabled people?

Depending on factors that include disposable income and age, there are senior citizen tax breaks. Please call the Clark County Assessor’s Office at (360) 397-2391 for details.

11104 N.E. 149th Street,

11104 N.E. 149th Street,